Landlord insurance plan is an important safeguard for property homeowners in britain, supplying customized protection for rental Qualities. Compared with regular household insurance, landlord insurance policy—generally known as landlords developing insurance policies or rental assets insurance—addresses the special pitfalls of leasing out a assets. In 2025, with rising expenses and evolving laws, comprehension landlord insurance plan in England is essential to preserving your expense whilst saving funds. This guidebook explores the essentials of landlord insurance policy, crucial issues, and income-conserving methods for United kingdom landlords.

What exactly is Landlord Insurance policy?

Landlord insurance policy is actually a specialized plan suitable for Houses rented to tenants. It generally involves landlords creating insurance policy, covering the composition on the home against threats like fireplace, floods, or structural injury. In contrast to standard dwelling insurance plan, it accounts for tenant-connected risks, which include house harm or lack of rental revenue. Optional add-ons, like contents coverage or authorized security, let landlords to customize protection based on their own requirements.

In England, landlord coverage isn’t legally demanded, nonetheless it’s highly encouraged. Home loan lenders normally mandate buildings insurance plan as being a affliction from the financial loan, and complete landlord insurance plan ensures broader safety. With rental Houses dealing with exclusive challenges, including tenant disputes or unpredicted repairs, the proper coverage presents peace of mind.

Crucial Parts of Landlord Coverage

Landlords Developing Insurance policies: Handles the assets’s structure, which includes walls, roofs, and fixtures like kitchens or loos. It shields from destruction from occasions like storms, fires, or vandalism.

Contents Insurance policy: Optional coverage for landlord-owned furnishings, for example carpets, curtains, or appliances. Perfect for furnished rentals.

Lack of Lease: Compensates for missing rental profits Should the property gets to be uninhabitable as a result of insured functions, just like a hearth.

Liability Insurance policy: Safeguards towards claims if a tenant or visitor is wounded over the assets.

Lawful Charges Deal with: Can help with charges connected with tenant disputes, for example eviction or unpaid lease.

Why Landlord Insurance coverage Matters in 2025

The united kingdom rental current market is progressively sophisticated, with new laws and economic pressures impacting landlords. Mounting repair service charges and stricter tenant rights mean landlords have to have sturdy safety. For example, storm-similar hurt has surged as a result of unpredictable weather, earning thorough landlords creating insurance critical. Moreover, tenant disputes or unpaid rent can pressure finances, highlighting the value of lawful and reduction-of-hire coverage.

Money-Conserving Strategies for Landlord Coverage

Examine Quotes: Use comparison internet sites to locate aggressive prices for landlord insurance plan in England. Search further than value to be certain satisfactory protection.

Bundle Policies: Combining structures and contents Landlord Home Insuranc coverage With all the exact supplier generally reduces premiums.

Raise Stability: Installing alarms, safe locks, or clever cameras can lower insurance policies prices by decreasing chance.

Pick out Higher Extra: Deciding on an increased voluntary excessive can reduce month to month rates, but make sure you can afford to pay for the surplus if a assert occurs.

Maintain the Home: Standard servicing, like correcting leaks or examining electrics, helps prevent highly-priced promises and could qualify for reductions.

Vet Tenants Extensively: Reputable tenants decrease the probability of harm or disputes, perhaps reducing premiums with time.

Selecting the Proper Coverage

When picking landlord residence insurance policy, take into account the house sort, tenant profile, and rental terms. For HMOs (houses in multiple profession), specialised procedures could possibly be necessary. Often study policy conditions to verify coverage for specific threats, like subsidence or destructive tenant hurt. In 2025, companies like Aviva, Immediate Line, and AXA present customized landlord insurance policy with flexible increase-ons.

Conclusion

Landlord insurance policy is a significant Resource for protecting your rental assets and money balance. By understanding your preferences, comparing offers, and applying cash-preserving techniques, you can safe Price-helpful coverage without compromising defense. Stay knowledgeable about plan alternatives and regulations to generate smart possibilities for the rental business enterprise in 2025.

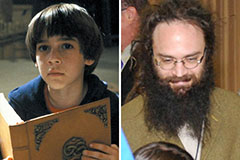

Barret Oliver Then & Now!

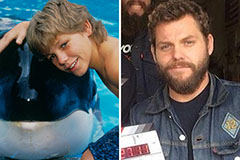

Barret Oliver Then & Now! Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Kenan Thompson Then & Now!

Kenan Thompson Then & Now! Lucy Lawless Then & Now!

Lucy Lawless Then & Now!